Michael Weis - Readying Your Business to Sell in Today's M&A Marketplace

by The Bloom Report | 12 Aug 2024

Industry Commentary, Op-Ed

Be a more qualified Seller-be prepared!

One would not go into a business meeting (nor a social meeting, for that matter) without being prepared. In the M&A space, this principle absolutely applies to those desiring to sell their business, and its importance cannot be understated. A potential Seller that has its “package” organized and ready to go is a much more attractive target than the opposite. It’s a better “look” for possible acquirers, and that pays off typically with higher dollars and better terms and conditions.

What does this mean practically? The following is a non-exclusive list:

- Complete, timely and accurate financial statements. No question there may be a red flag if a target does not have.

- An organized operational system-suppliers, customers, human resources, technology and the like.

- Legal house in order. Relationships evidenced where necessary by current, written, valid contracts. Corporate formalities observed and documented. Intellectual property properly protected.

- A management plan, that can clearly explain the entity’s business, its strengths and weaknesses. An understanding of its place in the market, knowledge of the competition. A budget.

- A clear organization, where qualified individuals (properly compensated and incentivized), enable the company to function at the highest possible level.

Purchasers who are interested in acquiring businesses are, during the due diligence process, thoroughly reviewing all legal, financial and operational aspects of a company. A suitor generally has to “sell” the proposed acquisition to its investors, directors and other stakeholders, and make the business case for the acquisition. A Seller wants to make it as easy as possible for the Purchaser to do so….and having everything in order is undoubtedly a big plus. Insiders of a Purchaser that have to “vote” on a deal, with a significant number of open issues, missing documentation, incomplete information, et. al. are simply not as likely to green light and move forward. Conventional thinking is that an unprepared/disorganized Seller is negatively correlated to the operations of that company as a whole.

We understand that companies like to manage the legal spend. But engaging legal counsel to review and assist in the legal side of deal preparation, is generally dollars well spent.

We are happy to help. Call us any time.

Recent Blogs

Recent Blogs

Reviews

Toy Review: Crazy Aaron's Thinking Putty, Land of Dough, & Slime Charmers

Press Release

GPI Partners with Kawakids to Bring Advanced Manufacturing to the North American Market

Reviews

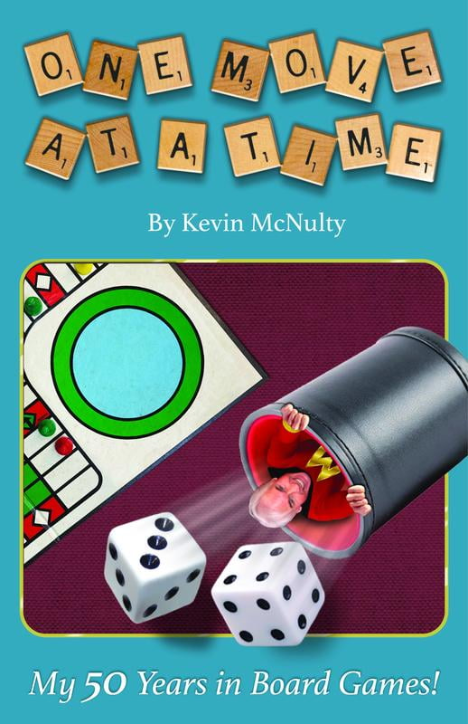

BOOK REVIEW: One Move at a Time by Kevin McNulty

Press Release

CARVE COMMUNICATIONS HOSTS CARVE-X @ TOY FAIR – EXCLUSIVE EVENT FEATURES HOTTEST TOYS AND GAMES FROM INDUSTRY LEADERS, CHALLENGER BRANDS, AND START-UPS

Reviews

Game Review: Q-Less

See more

Recent Wiki

PR and SOCIAL MEDIA

CARVE COMMUNICATIONS HOSTS CARVE-X @ TOY FAIR – EXCLUSIVE EVENT FEATURES HOTTEST TOYS AND GAMES FROM INDUSTRY LEADERS, CHALLENGER BRANDS, AND START-UPS

BOOK REVIEWS

BOOK REVIEW: One Move at a Time by Kevin McNulty

COMPANIES

GPI Partners with Kawakids to Bring Advanced Manufacturing to the North American Market

BOOK REVIEWS

Toy Review: Crazy Aaron's Thinking Putty, Land of Dough, & Slime Charmers

PEOPLE

Joe Kling Talks His Impact on the Industry, Career Highlights, and Advice to the Next Generation

See more

POP's Got Talent

POP Entertainment

Randy Klimpert Shares his Ukulele Collection

POP Entertainment

Steve Casino Peanut Art

POP Entertainment

Everyone's Talking about POP!

POP Entertainment

Princess Etch - a Multi-Talented Etch A Sketch Artist

POP Entertainment

Joseph Herscher of Joseph' s Machines.

See more

Recent POPcast

Hidden Role: The Brains Behind your Favorite Games

Connie Vogelmann designed Apiary & Wyrmspan!

Hidden Role: The Brains Behind your Favorite Games

Bob Fuhrer... Is THE Crocodile Dentist!

Hidden Role: The Brains Behind your Favorite Games

Tom Dusenberry... Bought Atari, Wizards of the Coast, and Avalon Hill!

Hidden Role: The Brains Behind your Favorite Games

Matt Leacock created Pandemic... the game!

Hidden Role: The Brains Behind your Favorite Games

Scott Brown and Tim Swindle... are Launching a New Sport!

See more

POPDuos

POPDuos: Interviews with Legends and Leaders

POPDuo: Richard Dickson, Mattel’s President & COO, and Kedar Narayan, Young Inventor Challenge AMB

POPDuos: Interviews with Legends and Leaders

POPDuo: Will Shortz and Josh Wardle

POPDuos: Legends and Leaders Explore Creativity

POP Duo: Elan Lee, Co-Founder, Exploding Kittens.and Jeff Probst, Host and Exec Producer, Survivor

POPDuos: Legends and Leaders Explore Creativity

POP Duo: David Fuhrer, MNG Director, Blue Sq Innovations & Shawn Green, past Dodgers & Mets MLB Star

POPDuos: Legends and Leaders Explore Creativity

POP Duo: Bob Fuhrer, Founder, Nextoy and Tom Fazio, Golf Course Designer

See more