Christopher Byrne: Entertainment 2023. Welcome to a New Reality.

by Christopher Byrne | 05 Oct 2023

Industry Commentary, Op-Ed

Anyone who’s been kicking around the kids’ space for a while understands the dynamic nature of children’s entertainment. The boom of technology, the always-on screen, the ever-present opportunity to interact with a favorite show or character 24/7 (well, allowing some time for eating, sleeping, and school) are defining features of kids’ entertainment in 2023. They’re a far cry from kids having to wait till Saturday morning to see their favorite shows, a concept that completely baffled my nieces who had grown up being their own programmers, choosing what they wanted to watch when.

This ubiquity and nearly universal access have created their own set of challenges. For years, marketers knew where the eyes were on Saturday morning and could easily target commercials to kids. Today, while we know kids are spending a lot of time on YouTube in addition to streaming and recording, the fragmentation of the marketplace makes launching shows a challenge. Add in TikTok and other social media, and cultural concern about screen time among kids, and you have a market that’s more crowded and fragmented than ever before.sful, it almost always has to have a strong merchandise program. This is not merely to delight fans; it’s also to generate the revenue that’s required to cover production costs and make profits, even when production is up north. (Thanks, Canada, for the tax credits!)

(Cocomelon—Another YouTube star, first launched in 2005)

I spent some time at Toy Fair walking the floor with two show runners who have an impressive list of credits. We talked about the essential component of merchandise and multiple platforms to create a successful property. If we look at the shows being cancelled, in many cases it’s because they don’t have a strong merchandise or franchise strategy of presence. In fact, if you think about it, the juggernaut success of Paw Patrol, Turtles, Peppa Pig, Miraculous, Blue and a handful of others, are more anomalies when you consider the number of shows being produced for kids—and even more the number being pitched. My friends were saying something many of us in the business have known for a while: licensing has gone from being an afterthought/add-on to an essential component of the pitch. They were shopping the show for potential partners or product concepts that might work for concepts they have in development.

Even as this industry evolves, though, there are still some elements that are constants.

My friends the show runners were also concerned about the impacts of the nearly five-month writers strike. It will cause a lull in production, which will inevitably have an impact on licensed goods. Though it won’t be an exact comparison, a 148-day delay in what are already tight production schedules (for shows and goods) has economic implications for everyone involved in new properties. Even with established properties that have slated introductions of new items based on new content.

(RoboForce—a 1980s franchise targeting a new audience from Nacelle Toys)

However, that’s only one factor in this bubbling stew of entertainment in kids’ worlds. We already know that that kids are accessing more programming (and ads) through YouTube than another platform. We also know that, in recent years particularly, kids are their own programmers. They choose what to watch when, whether through streaming, recording, or accessing online. That can make it more difficult to know who is watching what when and is changing measurement criteria for success. In my opinion, while many studios have leapt onto this and are recalibrating their metrics, as have some toy companies, overall content creators and potential licensees need to up their games, particularly when it comes to anticipating what is next. Of course, this is a risky endeavor because no one has a fully functioning crystal ball. What we do know is that the old M.O. of waiting till a property establishes itself to enter licensing, particularly toys, doesn’t work. We have Paw Patrol to thank for this. Within months—maybe weeks—of the show launch, parents were clamoring for product. Spin Master did an excellent job of responding, and their constant ability to reflect the hero play, which is the essence of the property, has contributed to the series’ longevity.

This is probably a good place to observe that while that strategy has inherent risks for toymakers, the economics of franchise and property development require strong licensing programs to be profitable. Licensing can no longer be an afterthought. A scalable rollout strategy is essential in today’s market. Quick entry and strategic exit, if needed, are critical now.

We also have to consider new players in the market. Jazwares, for instance, is leaning into the Metaverse. Roblox and Minecraft are destinations for kids, introducing them to new characters and new ways to play. The challenge is always in integrating online and offline play. From Microsoft’s Actimates in 1997 to Webkinz in 2005, to name just two, the question is whether distinct play patterns can complement one another. Moreover, given the proliferation of characters/properties on Roblox, which ones will kids want to take off the screen and play with? There’s nothing really new here; it’s the age old question potential licensees should be asking.

(Demon Slayer—part of the Anime explosion. Toy? Or Collectible? Does it matter?)

Similarly, with the boom in Anime, which properties will find an audience in toys or collectibles? Does Chainsaw Man have legs? Is Demon Slayer playable offline? That’s what makes this business so often a crapshoot.

Finally, as noted above, predicting hits as I walked around Toy Fair, there was a proliferation of toys based on Stitch, the alien character from Disney’s 2002, Oscar-nominated animated film Lilo and Stitch. It’s not because the movie is still a huge hit. It generated lower box office than many other Disney films. No, it’s because Stitch has become a huge social media hit. The adorable, chaos-causing character reflects a kind of humor that taps into the current zeitgeist. That’s his superpower, and why he’s a hit…for now.

It's likely that entertainment will continue to expand and evolve. Multi-platform strategies are the rule of the day for property owners and licensees. Finding your audience, your fans, and your opportunities is more demanding than ever before. In fact, to make a success—which is never guaranteed as we all know—you need to be everything everywhere all at once.

Oh, and it always helps to get lucky, too.

Related Blogs

Recent Blogs

Press Release

GPI Partners with Kawakids to Bring Advanced Manufacturing to the North American Market

Reviews

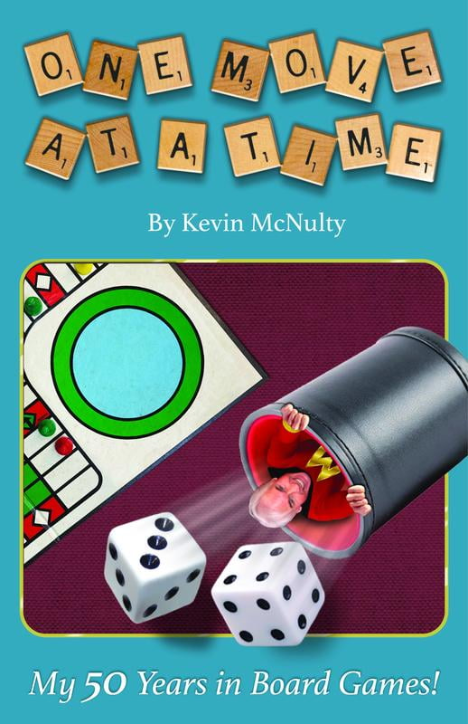

BOOK REVIEW: One Move at a Time by Kevin McNulty

Press Release

CARVE COMMUNICATIONS HOSTS CARVE-X @ TOY FAIR – EXCLUSIVE EVENT FEATURES HOTTEST TOYS AND GAMES FROM INDUSTRY LEADERS, CHALLENGER BRANDS, AND START-UPS

Reviews

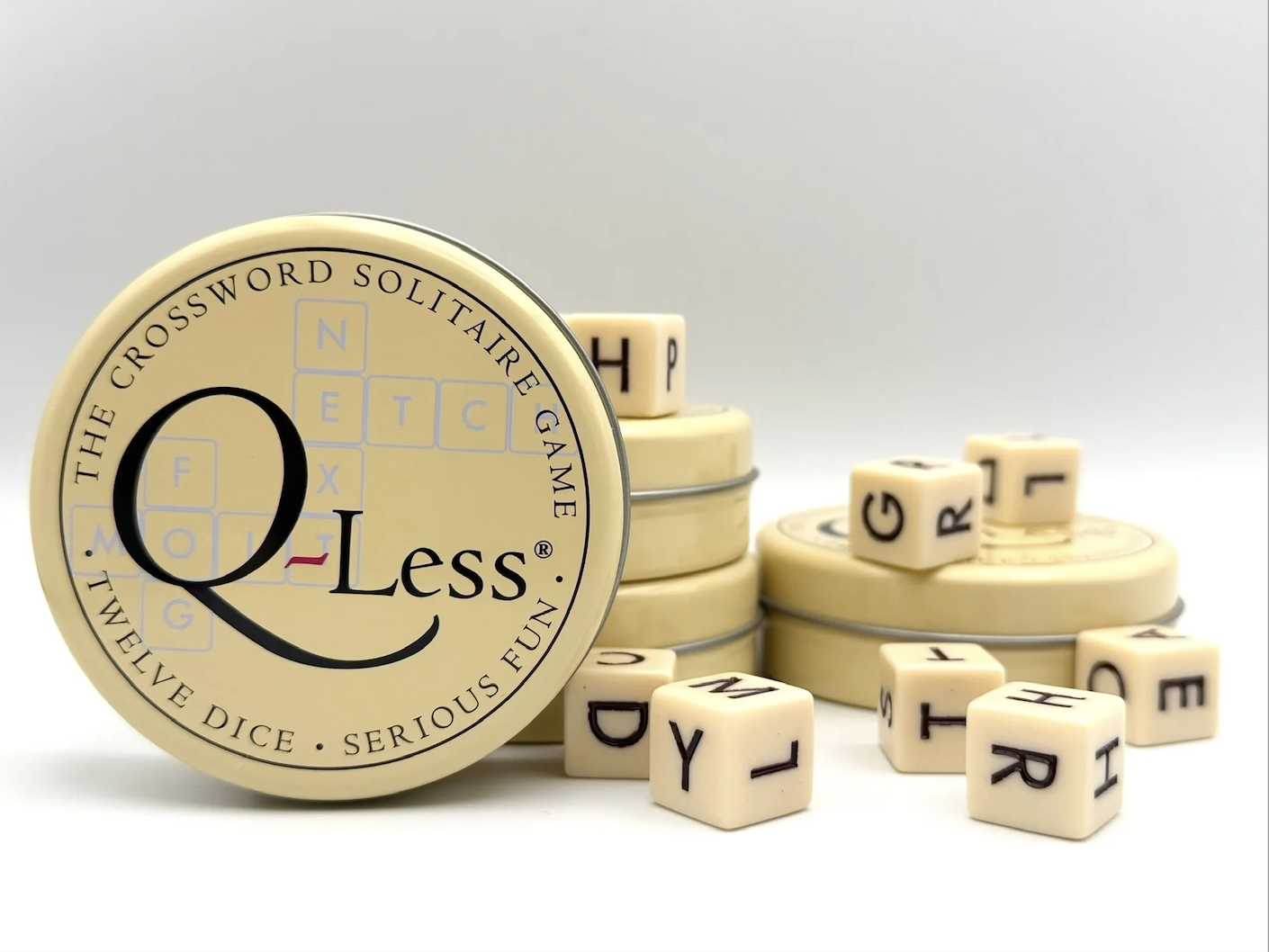

Game Review: Q-Less

Biographies and Interviews

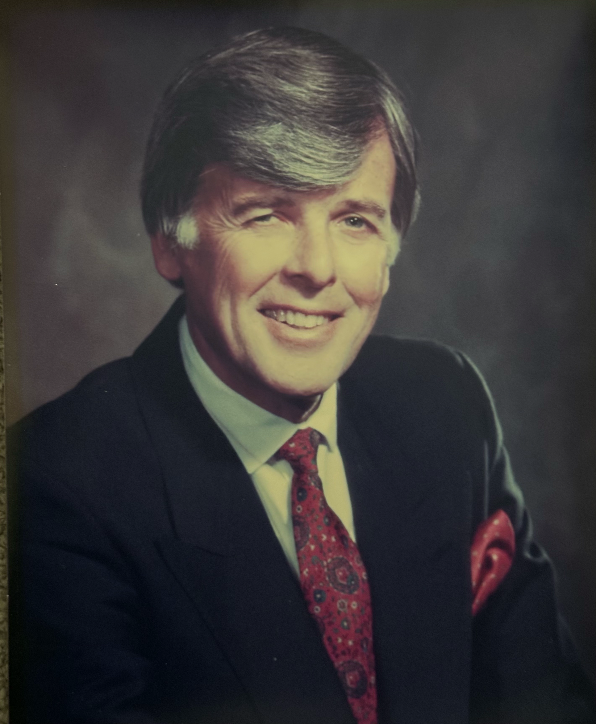

Joe Kling Talks His Impact on the Industry, Career Highlights, and Advice to the Next Generation

See more

Recent Wiki

PEOPLE

Joe Kling Talks His Impact on the Industry, Career Highlights, and Advice to the Next Generation

BOOK REVIEWS

Game Review: Q-Less

COMPANIES

York-Jersey Underwriters’ Celebrates 100 years in Business!

PEOPLE

Kevin Brougher talks Learning Games, Reindolphins and His Style of Music

PEOPLE

Inventor Brad Ross on his off Broadway Play, JUST DESSERTS: A Musical Bake-Off

See more

POP's Got Talent

POP Entertainment

Randy Klimpert Shares his Ukulele Collection

POP Entertainment

Steve Casino Peanut Art

POP Entertainment

Everyone's Talking about POP!

POP Entertainment

Princess Etch - a Multi-Talented Etch A Sketch Artist

POP Entertainment

Joseph Herscher of Joseph' s Machines.

See more

Recent POPcast

Hidden Role: The Brains Behind your Favorite Games

Connie Vogelmann designed Apiary & Wyrmspan!

Hidden Role: The Brains Behind your Favorite Games

Bob Fuhrer... Is THE Crocodile Dentist!

Hidden Role: The Brains Behind your Favorite Games

Tom Dusenberry... Bought Atari, Wizards of the Coast, and Avalon Hill!

Hidden Role: The Brains Behind your Favorite Games

Matt Leacock created Pandemic... the game!

Hidden Role: The Brains Behind your Favorite Games

Scott Brown and Tim Swindle... are Launching a New Sport!

See more

POPDuos

POPDuos: Interviews with Legends and Leaders

POPDuo: Richard Dickson, Mattel’s President & COO, and Kedar Narayan, Young Inventor Challenge AMB

POPDuos: Interviews with Legends and Leaders

POPDuo: Will Shortz and Josh Wardle

POPDuos: Legends and Leaders Explore Creativity

POP Duo: Elan Lee, Co-Founder, Exploding Kittens.and Jeff Probst, Host and Exec Producer, Survivor

POPDuos: Legends and Leaders Explore Creativity

POP Duo: David Fuhrer, MNG Director, Blue Sq Innovations & Shawn Green, past Dodgers & Mets MLB Star

POPDuos: Legends and Leaders Explore Creativity

POP Duo: Bob Fuhrer, Founder, Nextoy and Tom Fazio, Golf Course Designer

See more